Second Hand Car Finance Online: Raipur, the capital of Chhattisgarh, is a growing city with a lot of industrial and commercial activity. This makes it a great place to buy and sell pre-owned cars.

Poonawalla Fincorp understands the needs of the people in Raipur and offers Pre-Owned Car Loans that are tailored just for them. With good interest rates, flexible repayment options, and a quick approval process, we help people in Raipur make their dream of owning a reliable used car come true.

Whether you’re driving around town or heading out on road trips, Poonawalla Fincorp is here to support you, making sure you can start your car journey with confidence and ease.

Second Hand Car Finance Online 2024

Shriram Finance knows buying a car is a big deal and offers straightforward financing for used cars. Our loans are designed to make your car purchase smooth and easy. With great interest rates and flexible repayment options, getting a loan is simple. Applying for a Shriram Pre-Owned Car Loan is quick and hassle-free. Apply today and make your dream car a reality.

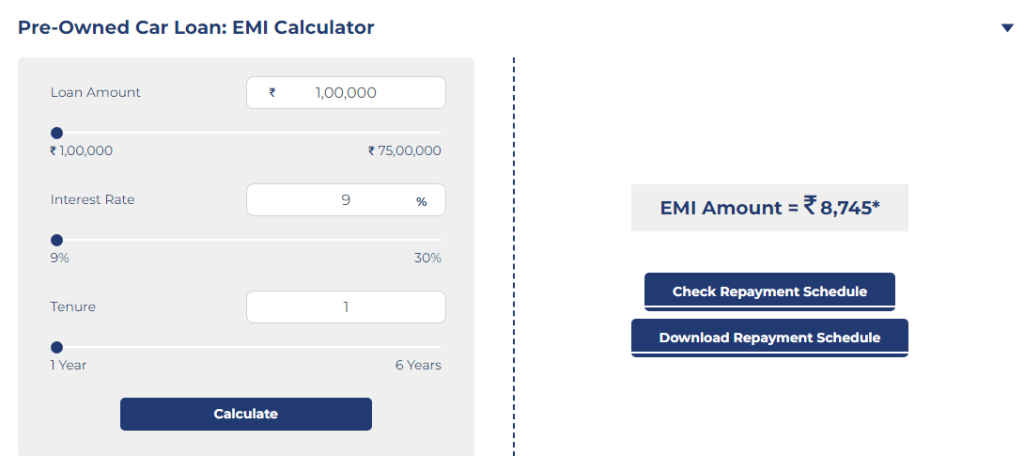

Pre-Owned Car Loan: EMI Calculator

Pre-Owned Car Loan Interest Rates in Raipur

Flexible Repayment Options

We offer Pre-Owned Car Loans with flexible repayment options of up to 72 months, allowing you to choose a tenure that suits your financial capabilities.

Minimal Documentation

The loan application process is streamlined with minimal documentation requirements, making it convenient and time efficient.

Quick Disbursal

Once your loan is approved, funds are disbursed swiftly, enabling you to seize your dream car without delay.

Budget-friendly EMIs

With attractive interest rates and personalized repayment plans, you can comfortably manage your monthly EMIs.

High Loan Amounts

Our Used Car Loans in Raipur provide substantial loan amounts, ensuring that you can afford the car of your choice.

Apply for Pre-Owned Car Loan online in 4 Easy Steps

How to Apply for a Pre-Owned Car Loan in Raipur?

To apply for a Used Car Loan in Raipur, follow these steps: – Second Hand Car Finance Online

- Check Your Eligibility: Visit our website to see if you qualify for a loan.

- Apply for the Loan: Choose the loan option and click ‘Apply Now’.

- Fill Out the Form: Complete the application form with your information.

- Submit Your Documents: Upload the necessary documents for your loan.

- Review and Approval: After you submit your application, our team will review it. Once everything is checked, we’ll process your loan.

If you’d rather talk to us in person, feel free to visit our branch at the address provided.

Features & Benefits

Competitive interest rates

Competitive interest rates on used car loans start at 13%* p.a..

Flexible Repayments

Flexible and convenient repayment tenure of up to 48 months.

Up to 85% financing on Used Car’s Value

Get up to 85% financing on a Pre-Owned Car based on eligibility.

Easy to Apply

With our simple online application process, you can apply in just a few clicks.

Minimal Documentation

With minimal documentation required, you can get the loan quickly and easily.

Quick Approvals & Disbursals

Enjoy the convenience of financing your second-hand car with fast approvals.

Regular Reminders

Get timely notifications, so you never miss a payment

Eligibility Criteria & Documents Required

Eligibility for a Pre-Owned Car loan from Shriram Finance depends on the individual and the vehicle. The essential eligibility criteria are as below: – Second Hand Car Finance Online

FAQ’s

1. What is a second-hand car loan?

It’s a loan to help you buy a used car. You borrow the money and pay it back in monthly payments.

2. How can I apply for a used car loan online?

Visit the lender’s website, check if you qualify, fill out the online form, and upload the needed documents. You’ll get a response after they review your application.

3. What documents do I need?

You’ll need to provide proof of identity, address, income, and details about the car you want to buy.

4. How is the loan amount decided?

The amount you can borrow depends on your income, credit history, and the car’s value. The lender will look at these factors to decide how much they can lend you.

5. What interest rates are available?

Interest rates vary based on your credit and the lender. It’s smart to compare rates from different lenders to find the best deal.

Conclusion

Second Hand Car Finance Online: getting a used car loan online is an easy way to help you buy a used car. Just check if you qualify, apply online, and provide the required documents. Compare different lenders to find the best rates and repayment options for you. If your application isn’t approved, review your finances and work on improving your credit before reapplying. For more financial tips and updates, visit finrollnews.com. With these steps, you’ll be driving your new used car soon.

READ MORE:-

Top 10 MicroFinance Company in India 2024 – Interest Rate & Eligibility

Banking Sector Essentials for Beginners: Key Terms, Concepts, and Financial Ratios for Bank Stocks

Micro Finance Company Ltd 2024: Definition, Benefits, History, and How It Works