Mahindra Finance Personal Loan Review: At Mahindra Finance, we believe in making lending personal, offering you the funds you need exactly when you need them.

Our personal loans come with attractive interest rates and flexible EMI options, making it easier for you to manage your expenses without stretching your budget.

Our instant personal loans are available for our customers and Mahindra Group employees. Whether you’re planning a wedding, consolidating debts, or renovating your home, our low-interest loans are here to help you achieve your goals.

We ensure a smooth experience from start to finish, with a loan that fits your life perfectly!

Mahindra Finance Personal Loan Review

Mahindra Finance offers personal loans that are easy to understand, flexible, and come with good interest rates. Whether you need money for something big, to pay off debt, or cover unexpected expenses, Mahindra Finance has a simple process designed to fit your needs.

In this review, we’ll take a look at the key features, benefits, and what customers have to say, to help you decide if this loan is the right fit for you.

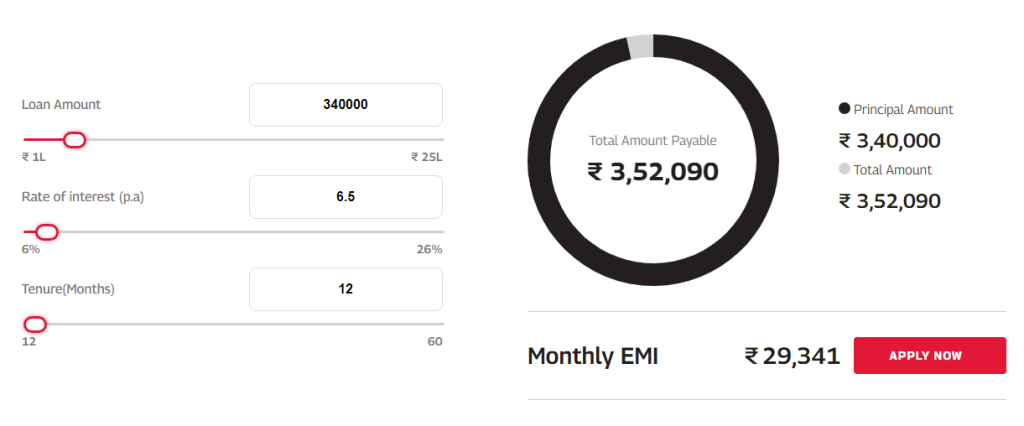

Personal Loan EMI Calculator

Figuring out your EMI is now super easy. Just use our Personal Loan EMI Calculator—enter your loan amount, interest rate, and tenure, and you’ll instantly see your monthly payments.

You can also tweak the amount and tenure to see how it changes your EMI. Make quick and confident decisions with our Personal Loan EMI Calculator! – Mahindra Finance Personal Loan Review

Personal Loan Features and Benefits

Borrow with Confidence

Borrowing options start from INR 50,000 up to 15 Lakhs

Limited Interest Duration

You get the option to pay interest only for 12-24 months

Flexible Repayment Options

Choose your tenure from 24-60 months, with no pre-payment penalty

Minimal Documentation

With minimal documentation you can get the funds you require within few days

How to Apply for a Personal Loan

Getting a Personal Loan with us is quick and easy. You can apply online in just 4 simple steps or visit your nearest branch if you prefer. Either way, you’ll get a fast response!

Step 1: Fill in your contact details

Start by simply submitting your Phone Number on this form.

Step 2: Get a Call Back

Our executive will contact you for additional details.

Step 3: Document Verification & Approval

Submit the requested documents for eligibility check and verification

Step 4: Successful Disbursal

Once verified and approved, your funds will be sanctioned and disbursed.

Personal Loan Eligibility & Documents

Mahindra Finance Personal Loan Review: Mahindra Finance personal loans are available to existing customers with good repayment history and Mahindra Group employees, aged 21-58 with 2 years of service.

KYC Documents – PAN card copy mandatory and any one of the following: Voter ID, Aadhaar Card (with first 8 digits masked), Passport

Address Proof-Telephone Bill, Gas Bill, Bank Statement

Other Documents- Salary Slip (3 Months), Bank statement in PDF format (Last 3 months), Cancelled cheque (signature should be the same as signature on PAN Card), Passport size photograph

Personal Loan Interest and Charges

Interest Rates

Attractive Interest Rates based on your eligibility*

Processing Fees

Charged based on your product-specific, document, and stamp fees based on the prevailing rates set by the statutory authority and the location of the contract execution.

FAQ’s

How long will it take for me to receive my personal loan?

Few hours for our digital loans for customers, and within a day for our employees.

Do I need a bank account in order to receive my personal loan?

Yes.

Where can I get a personal loan from?

You can get your pre-approved personal loan from here for our mature customers. Our current customers can reach out to the nearest branch or click here

How can I repay a personal loan?

The personal loan can be repaid by E-Nach mandate.

Can I prepay my personal loan?

Yes, you can prepay your personal loan at a nominal pre-closure rate.

Conclusion

Mahindra Finance Personal Loan Review: Mahindra Finance’s personal loans make it easy to get the money you need quickly. With reasonable interest rates and a simple application process, they’re a good choice for managing your expenses. If you need a loan that works with your budget, Mahindra Finance is a solid option. For more information, visit finrollnews.com.