Jio Finance Share Price Today 2024: Jio Financial Services Ltd. shared that it has been approved by the Department of Economic Affairs, Ministry of Finance, to increase its foreign investment limit to 49 percent of its total equity. This change will let more foreign investors and Portfolio Investors (FPIs) get involved.

Back in May 2024, the company, led by Mukesh Ambani, asked its shareholders to approve raising the foreign investment cap to 49 percent. This move is aimed at bringing in more foreign money and helping the company grow.

For the quarter ending March 2024, Jio Financial Services reported a 6 percent rise in net profit, reaching Rs 311 crore, up from Rs 294 crore in the previous quarter. Revenue from operations stayed roughly the same at Rs 418 crore, compared to Rs 414 crore in the December quarter.

Jio Financial Services announced a new partnership with BlackRock, Inc. to set up a wealth management and broking business. This joint venture is designed to make investing easier for people in India by offering digital-first solutions. The deal with BlackRock is a key part of Jio Financial’s plan to expand its reach in wealth management.

Must Read:- Bajaj Finance Personal Loan Ltd: Home Loans, Cards, Insurance, Investments, Loan Against Property…

Jio Finance Share Price Today 2024 – About us

Jio Finance Share Price Today 2024. was originally incorporated as Reliance Strategic Investments Private Limited on July 22, 1999, under the Companies Act 1956. Subsequently, the name of the Company was changed to Reliance Strategic Investments Limited and a fresh certificate of incorporation was issued on January 14, 2002. The name of the Company was further changed to ‘Jio Financial Services Limited’ and a fresh certificate of incorporation was issued on July 25, 2023.

Our Company is a systemically important non-deposit-taking Non-Banking Financial Company registered with the Reserve Bank of India.

CIN: L65990MH1999PLC120918

Our Company will be a holding company and will operate its financial services business through its consumer-facing subsidiaries namely Jio Finance Limited (JFL), Jio Insurance Broking Limited (JIBL), and Jio Payment Solutions Limited (JPSL) and joint venture namely Jio Payments Bank Limited (JPBL).

Introducing Loans by Jio Finance

Jio Finance Share Price Today 2024: Want to buy your dream home or get your teen a new phone? Jio Finance can help with home loans and Loan on Mutual Funds (LoMF) at great rates and easy monthly payments. Our home loans make it easier to own a home, and LoMF can cover everything from vacations and weddings to education and more.

Transform mutual funds into financial freedom

You don’t need to sell your mutual funds for quick cash anymore. With Loan on Mutual Funds (LoMF), you can borrow up to 50% of their value at a good interest rate. You’ll only pay interest on the amount you actually use. And while you take care of your current needs, your investment stays safe and continues to grow.

Now make your dream home your real home

Always wanted to buy a perfect home for your family? Your dream is almost here. Jio Finance is rolling out a new home loan with easy paperwork, great interest rates, and flexible terms. We’re here to make buying your home a smooth and happy experience.

Discover more about insurance plans

Jio Finance Share Price Today 2024 We offer personalized insurance solutions for individuals and businesses. Following strict rules and regulations, we always put our customers first and provide services across the country. Our team of experienced Insurance Guides is here to help you with all your insurance needs.

Insurance plans at your fingertips

No more annoying calls from agents. With Jio Insurance Broking, you can explore insurance options from different companies. Compare plans easily and choose the one that’s right for you. You can also manage and renew your policies without any hassle.

Multiple plans under one roof

No need to check multiple insurance companies to find the right plan. With Jio Insurance Broking, you can see and compare different options from various insurers all in one place. Plus, you can customize these plans to match your exact needs, all at great rates.

Profit & Loss

Consolidated Figures in Rs. Crores / View Standalone Related Party

| Name | Mar 2023 | Mar 2024 | TTM |

|---|---|---|---|

| Sales + | 45 | 1,854 | 1,858 |

| Expenses + | 6 | 296 | 331 |

| Operating Profit | 39 | 1,558 | 1,526 |

| OPM % | 88% | 84% | 82% |

| Other Income + | 10 | 429 | 424 |

| Interest | 0 | 10 | 0 |

| Depreciation | 0 | 22 | 22 |

| Profit before tax | 49 | 1,956 | 1,929 |

| Tax % | 37% | 18% | |

| Net Profit + | 31 | 1,605 | 1,585 |

| EPS in Rs | 2.53 | 2.49 | |

| Dividend Payout % | 0% | 0% |

| Compounded Sales Growth | |

|---|---|

| 10 Years: | % |

| 5 Years: | % |

| 3 Years: | % |

| TTM: | 4034% |

Must Read:- Mahindra Finance Personal Loan Review: Eligibility & Documents Required For Personal Loan In India

| Compounded Profit Growth | |

|---|---|

| 10 Years: | % |

| 5 Years: | % |

| 3 Years: | % |

| TTM: | 6282% |

| Stock Price CAGR | |

|---|---|

| 10 Years: | % |

| 5 Years: | % |

| 3 Years: | % |

| 1 Year: | 53% |

| Return on Equity | |

|---|---|

| 10 Years: | % |

| 5 Years: | % |

| 3 Years: | % |

| Last Year: | 1% |

Balance Sheet

Consolidated Figures in Rs. Crores / View StandaloneCorporate actions

| Name | Mar 2023 | Mar 2024 |

|---|---|---|

| Equity Capital | 2 | 6,353 |

| Reserves | 114,118 | 132,794 |

| Borrowings + | 743 | 0 |

| Other Liabilities + | 66 | 5,715 |

| Total Liabilities | 114,930 | 144,863 |

| Fixed Assets + | 158 | 175 |

| CWIP | 38 | 0 |

| Investments | 108,141 | 133,292 |

| Other Assets + | 6,593 | 11,396 |

| Total Assets | 114,930 | 144,863 |

Cash Flows

Consolidated Figures in Rs. Crores / View Standalone

| Name | Mar 2023 | Mar 2024 |

|---|---|---|

| Cash from Operating Activity + | 2,055 | -678 |

| Cash from Investing Activity + | -1,110 | 1,441 |

| Cash from Financing Activity + | -889 | -753 |

| Net Cash Flow | 56 | 11 |

Ratios

Consolidated Figures in Rs. Crores / View Standalone

| Name | Mar 2023 | Mar 2024 |

|---|---|---|

| Debtor Days | 113 | 3 |

| Inventory Days | ||

| Days Payable | ||

| Cash Conversion Cycle | 113 | 3 |

| Working Capital Days | 3,644 | 4 |

| ROCE % | 2% |

Shareholding Pattern

Numbers in percentagesQuarterlyYearlyTrades

1 Recently

| Name | Sep 2023 | Dec 2023 | Mar 2024 | Jun 2024 |

|---|---|---|---|---|

| Promoters + | 46.77% | 47.12% | 47.12% | 47.12% |

| FIIs + | 21.58% | 19.83% | 19.45% | 17.55% |

| DIIs + | 13.64% | 12.99% | 12.50% | 11.79% |

| Government + | 0.13% | 0.14% | 0.14% | 0.15% |

| Public + | 17.86% | 19.92% | 20.77% | 23.39% |

| No. of Shareholders | 39,83,144 | 40,83,129 | 43,99,041 | 48,02,851 |

FAQ’s

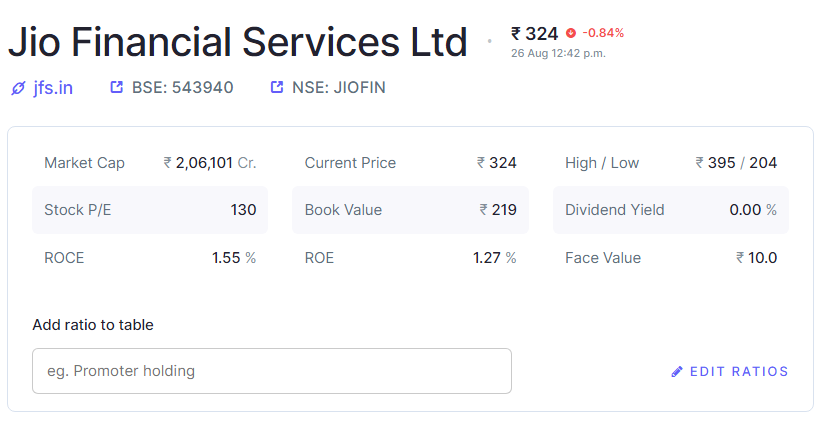

1. What’s the current share price of Jio Finance?

- You can check the latest share price on financial news sites, stock market apps, or Jio Finance’s official website.

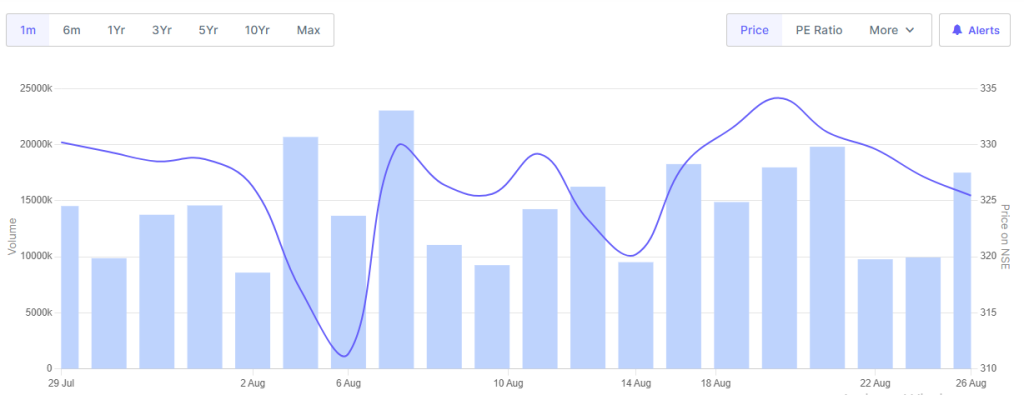

2. How has Jio Finance’s share price changed this year?

- Look at historical price charts on financial news sites to see how the share price has moved this year.

3. What’s affecting Jio Finance’s share price in 2024?

- The share price can be influenced by earnings reports, market trends, the economy, and news from the industry. Keeping up with news and financial reports will help you understand these changes.

4. Where can I find detailed financial info about Jio Finance?

- Check their quarterly and annual reports on their official website or look for financial news articles.

5. Are there any recent updates from Jio Finance that might affect its share price?

- Look at recent press releases or news articles to find out if there are any new updates that could impact the share price.

Conclusion

Jio Finance Share Price Today 2024: To keep track of Jio Finance’s share price in 2024, regularly check financial news websites, stock market apps, and their official site. For more updates and detailed information, visit finrollnews.com. Whether you’re considering investing or just following the company, these resources will help you stay informed.