Indiabulls Housing Finance Ltd 2024: is a top company in India that helps people buy homes by offering home loans. They also provide loans for building or improving houses. Indiabulls makes getting a home loan simple and easy. For more info, check out their website or talk to a financial advisor.

The Indiabulls Group is a large company based in Gurgaon, India. They focus mainly on housing finance, consumer finance, and real estate. They’re also involved in other areas like wealth management, renting out construction equipment, pharmaceuticals, and LED lighting.

History

Indiabulls Housing Finance Ltd 2024: Indiabulls started in 2000 with the launch of Indiabulls Financial Services, a stockbroking company founded by Sameer Gehlaut, Rajiv Rattan, and Saurabh Mittal, all IIT Delhi grads. The company soon expanded into stockbroking, consumer finance, housing finance, and real estate.

In 2004, Indiabulls Financial Services went public. Later, in 2006 and 2008, it split off its real estate and securities businesses.

In 2013, the company merged with its housing finance arm to become the main part of the group.

In 2014, the group split, with Sameer Gehlaut taking charge of Indiabulls Housing Finance and other businesses, while Rajiv Rattan and Saurabh Mittal took over Indiabulls Power (now RattanIndia Power) and Indiabulls Infrastructure (now RattanIndia Infrastructure).

By 2017, Indiabulls Housing Finance was the second-largest housing finance company in India and was part of the NIFTY 50 index. However, between late 2018 and 2019, the company faced problems, including a drop in its stock and bond values.

In 2020, Indiabulls decided to exit real estate through a merger with Embassy Group. Sameer Gehlaut stepped down as chairman in 2020 and left the company by 2023.

In 2021, Groww bought Indiabulls AMC, the company’s mutual funds business, for ₹175 crore. – Indiabulls Housing Finance Ltd 2024

Must Read:- Indian Railway Finance Corporation Ltd 2024: Share/Stock price Live

Indiabulls Housing Finance Ltd 2024. Stock Performance

| YTD | 1 Month | 3 Months | 1 Year | 3 Years | 5 Years | 10 Years | |

|---|---|---|---|---|---|---|---|

| Indiabulls Housing | -13.30 | 1.90 | 1.40 | 8.66 | -5.59 | -16.67 | -6.95 |

| BSE Finance | 9.45 | 1.78 | 6.54 | 21.17 | 12.27 | 14.34 | — |

| BSE Small Cap | 30.75 | 3.79 | 16.25 | 54.75 | 29.05 | 35.56 | 18.46 |

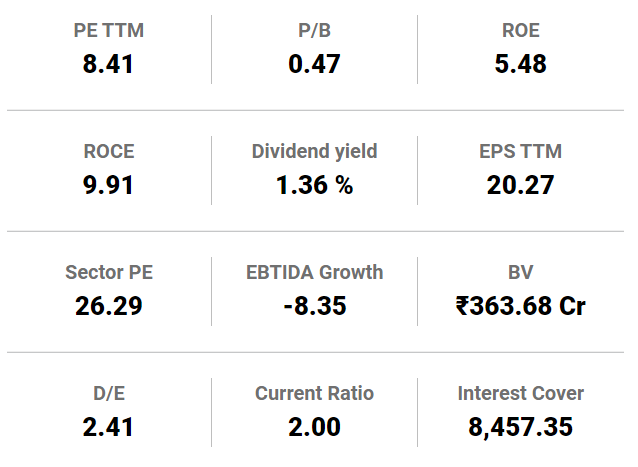

Indiabulls Housing Finance Ltd 2024 Key Ratios

Indiabulls Housing Finance Ltd 2024 Balance Sheet

| Particulars (Sources Of Funds) | Mar 2023 | Mar 2022 | Mar 2021 | Mar 2020 | Mar 2019 |

|---|---|---|---|---|---|

| Share Capital | 94.32 | 93.71 | 92.47 | 85.51 | 85.48 |

| Reserves | 15,934.61 | 15,558.62 | 15,429.74 | 14,844.09 | 17,173.44 |

| Borrowings | 47,473.11 | 56,897.45 | 63,072.08 | 73,040.64 | 96,204.58 |

| Other Liabilities | 4,639.02 | 3,529.30 | 4,877.98 | 4,682.33 | 7,193.12 |

| Total Liabilities | 68,141.06 | 76,079.08 | 83,472.27 | 92,652.57 | 120,102.71 |

| Fixed Assets | 627.87 | 531.64 | 464.83 | 581.92 | 311.02 |

| Accumulated Depreciation | 262.64 | 268.43 | 236.06 | 206.35 | 170.50 |

| CWIP | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Investments | 9,913.00 | 10,222.64 | 10,017.75 | 16,166.76 | 25,925.95 |

| Other Assets | 57,862.83 | 65,593.23 | 73,225.75 | 76,110.24 | 94,036.24 |

| Total Assets | 68,141.06 | 76,079.08 | 83,472.27 | 92,652.57 | 120,102.71 |

Indiabulls Housing Finance Ltd 2024 Profit & Loss

| Particulars(Income) | Mar 2023 | Mar 2022 | Mar 2021 | Mar 2020 | Mar 2019 |

|---|---|---|---|---|---|

| Sales | 7,363.76 | 7,765.39 | 8,718.80 | 11,399.23 | 15,407.35 |

| Expenses | 1,061.23 | 882.74 | 961.76 | 1,061.18 | 1,197.42 |

| Operating Profit | 6,302.53 | 6,882.65 | 7,757.04 | 10,338.05 | 14,209.93 |

| OPM PerChange | 85.59 | 88.63 | 88.97 | 90.69 | 92.23 |

| Other Income | 17.02 | 12.31 | 33.99 | 16.07 | 31.77 |

| Interest | 5,131.09 | 5,864.66 | 6,308.04 | 7,709.60 | 9,057.11 |

| Depreciation | 82.65 | 74.40 | 90.82 | 97.80 | 36.97 |

| Profit before tax | 1,105.81 | 955.90 | 1,392.17 | 2,546.72 | 5,147.62 |

| Tax PerChange | 25.92 | 27.18 | 23.97 | 15.19 | 27.55 |

| Net Profit | 819.17 | 696.11 | 1,058.46 | 2,159.91 | 3,729.26 |

| EPS in Rs | 15.49 | 13.25 | 20.42 | 45.06 | 77.82 |

| Dividend Payout PerChange | 7.20 | 0.00 | 39.31 | 70.12 | 50 |

Must Read:- Power Finance Corporation Ltd 2024: Share price today, Stock Price, Financials, Mutual Funds Invested & News

Indiabulls Housing Finance Ltd 2024 Quartely Results

Standalone Consolidated

| Particulars | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | Sep 2022 | Jun 2022 | Mar 2022 | Dec 2021 | Sep 2021 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Income from operations | 1,902.53 | 1,979.32 | 1,766.90 | 1,867.45 | 1,766.31 | 1,899.73 | 1,985.15 | 1,796.77 | 1,745.39 | 1,781.11 | 2,030.49 | 1,913.77 |

| Other Operating Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Total Income from operations | 1,902.53 | 1,979.32 | 1,766.90 | 1,867.45 | 1,766.31 | 1,899.73 | 1,985.15 | 1,796.77 | 1,745.39 | 1,781.11 | 2,030.49 | 1,913.77 |

| Total Expenses | 1,594.64 | 1,677.79 | 1,534.64 | 1,552.21 | 1,480.31 | 1,605.71 | 1,676.66 | 1,507.66 | 1,548.24 | 1,483.33 | 1,769.48 | 1,768.26 |

| Finance Costs | 1,200.27 | 1,178.84 | 1,194.35 | 1,223.30 | 1,236.69 | 1,229.78 | 1,260.81 | 1,265.97 | 1,374.54 | 1,467.47 | 1,493.86 | 1,466.75 |

| Cost of Sales/Operating Cost | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 63.30 | 0.00 | 0.00 | 22.19 | 6.87 | 21.19 |

| Employee Cost | 143.63 | 141.04 | 140.28 | 138.91 | 155.91 | 95.31 | 185.49 | 128.33 | 68.15 | 106.08 | 130.50 | 91.08 |

| Depreciation, amortization and depletion expense | 18.19 | 19.84 | 21.93 | 21.24 | 17.89 | 21.18 | 22.39 | 21.82 | 17.26 | 19.02 | 19.68 | 17.90 |

| Provisions & Write Offs | 181.46 | 274.48 | 139.97 | 133.81 | 33.80 | 192.61 | 95.13 | 55.40 | 42.01 | -177.11 | 71.45 | 131.52 |

| Administrative and Selling Expenses | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Expenses | 51.09 | 63.59 | 38.11 | 34.95 | 36.02 | 66.83 | 49.54 | 36.14 | 46.28 | 45.68 | 47.12 | 39.82 |

| Pre Operation Expenses Capitalised | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Profit from operations before other income and exceptional items | 307.89 | 301.53 | 232.26 | 315.24 | 286.00 | 294.02 | 308.49 | 289.11 | 197.15 | 297.78 | 261.01 | 145.51 |

| Other Income | 31.04 | 52.33 | 71.32 | 17.61 | 17.78 | 4.30 | 3.46 | 4.07 | 5.21 | 4.34 | 2.68 | 2.74 |

| Profit from ordinary activities before exceptional items | 338.93 | 353.86 | 303.58 | 332.85 | 303.78 | 298.32 | 311.95 | 293.18 | 202.36 | 302.12 | 263.69 | 148.25 |

| Exceptional Items | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Adjustments Before Tax | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Profit from ordinary activities before tax | 338.93 | 353.86 | 303.58 | 332.85 | 303.78 | 298.32 | 311.95 | 293.18 | 202.36 | 302.12 | 263.69 | 148.25 |

| Total Tax | 82.30 | 78.36 | 77.84 | 85.22 | 62.83 | 82.06 | 82.57 | 70.92 | 51.08 | 93.01 | 73.67 | 40.33 |

| Net profit from Ordinary Activities After Tax | 256.63 | 275.50 | 225.74 | 247.63 | 240.95 | 216.26 | 229.38 | 222.26 | 151.28 | 209.11 | 190.02 | 107.92 |

| Profit / (Loss) from Discontinued Operations | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Net profit from Ordinary Activities/Discontinued Operations After Tax | 256.63 | 275.50 | 225.74 | 247.63 | 240.95 | 216.26 | 229.38 | 222.26 | 151.28 | 209.11 | 190.02 | 107.92 |

| Extraordinary items | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Adjustments After Tax | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Net Profit after tax for the Period | 256.63 | 275.50 | 225.74 | 247.63 | 240.95 | 216.26 | 229.38 | 222.26 | 151.28 | 209.11 | 190.02 | 107.92 |

| Other Comprehensive Income | 28.69 | 117.93 | 5.62 | 276.92 | -97.25 | -180.18 | 12.74 | -76.81 | 254.68 | -12.95 | 124.61 | -9.60 |

| Total Comprehensive Income | 285.32 | 393.43 | 231.36 | 524.55 | 143.70 | 36.08 | 242.12 | 145.45 | 405.96 | 196.16 | 314.63 | 98.32 |

| Equity | 115.70 | 114.99 | 98.49 | 95.91 | 94.32 | 94.32 | 94.32 | 94.32 | 94.32 | 93.71 | 93.11 | 92.49 |

| Reserve & Surplus | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Face Value | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 |

| EPS before Exceptional/Extraordinary items-Basic | 4.19 | 4.82 | 4.67 | 5.24 | 5.11 | 4.59 | 4.86 | 4.71 | 3.21 | 4.49 | 4.11 | 2.33 |

| EPS before Exceptional/Extraordinary items-Diluted | 4.17 | 4.82 | 4.61 | 5.16 | 5.09 | 4.56 | 4.82 | 4.68 | 3.21 | 4.49 | 4.09 | 2.32 |

| EPS after Exceptional/Extraordinary items-Basic | 4.19 | 4.82 | 4.67 | 5.24 | 5.11 | 4.59 | 4.86 | 4.71 | 3.21 | 4.49 | 4.11 | 2.33 |

| EPS after Exceptional/Extraordinary items-Diluted | 4.17 | 4.82 | 4.61 | 5.16 | 5.09 | 4.56 | 4.82 | 4.68 | 3.21 | 4.49 | 4.09 | 2.32 |

| Book Value (Unit Curr.) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Dividend Per Share(Rs.) | 0.00 | 0.00 | 0.00 | 1.25 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Dividend (%) | 0.00 | 0.00 | 0.00 | 62.50 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| No. of Employees | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Debt Equity Ratio | 2.33 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.26 | 0.00 | 0.00 | 0.00 |

| Debt Service Coverage Ratio | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Service Coverage Ratio | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Debenture Redemption Reserve (Rs cr) | 146.39 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 146.39 | 0.00 | 0.00 | 0.00 |

| Paid up Debt Capital (Rs cr) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Non Performing Assets | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Net Non Performing Assets | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| (%) Gross Non Performing Assets | 3.37 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 4.11 | 0.00 | 0.00 | 0.00 |

| (%) Net Non Performing Assets | 2.02 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.36 | 0.00 | 0.00 | 0.00 |

| Return on Assets(Annualised) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Return on Assets(Non Annualised) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Provision Coverage Ratio(%) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Net Interest Margin(%) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Return on Equity(%) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses to Net Interest Income(%) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Loans Spreads(%) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Capital Adequacy Ratio | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 24.22 | 0.00 | 0.00 | 0.00 |

| Tier I Capital | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Tier II Capital | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Cost to Income Ratio | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Loan Loss Provision Ratio | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Loan Book(Amt Rs cr) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Loans Disbursed(Amt Rs cr) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Loans Sanctioned/Approved(Amt Rs cr) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Net Interest Income(Amt Rs cr) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses(Amt Rs cr) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Loan Losses & Provision(Amt Rs cr) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Assets Under Management(Amt Rs cr) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

Indiabulls Housing Finance Ltd 2024 Cash Flow

| Particulars(Income) | Mar 2023 | Mar 2022 | Mar 2021 | Mar 2020 | Mar 2019 |

|---|---|---|---|---|---|

| Cash from Operating Activity | 1,766.91 | 1,447.71 | 7,601.26 | 14,080.24 | 27,425.75 |

| Cash from Investing Activity | 2,582.87 | 1,283.64 | 2,580.85 | 9,726.29 | -7,446.05 |

| Cash from Financing Activity | -9,117.85 | -6,370.87 | -10,428.29 | -25,671.52 | -10,506.17 |

| Net CashFlow | -4,768.07 | -3,639.52 | -246.18 | -1,864.99 | 9,473.53 |

Indiabulls Housing Finance Ltd 2024 Share Holding Pattern

| Jun 2024 | Mar 2024 | Feb 2024 | Dec 2023 | |

|---|---|---|---|---|

| Promoters Holding | 0.00% | 0.00% | 0.00% | 0.00% |

| FIIs Holding | 19.14% | 19.33% | 20.41% | 23.42% |

| DIIs Holding | 5.92% | 6.43% | 5.88% | 8.25% |

| Public Holding | 74.94% | 74.24% | 73.71% | 68.33% |

FAQ’s

1. What is Indiabulls Housing Finance Ltd?

- Indiabulls Housing Finance Ltd 2024 is a big company in India that gives out home loans and helps with housing-related finance.

2. services does Indiabulls Housing Finance offer?

- Home Loans: Money to buy or build a new home.

- Loan Against Property: Loans using your property as security.

- Construction Loans: Loans to build a new house or make major improvements.

3. How can I apply for a home loan with Indiabulls Housing Finance?

- You can apply for a home loan online on their website or visit one of their offices. You’ll need to provide details about your income and property.

4. What are the benefits of getting a loan from Indiabulls Housing Finance?

- Good Interest Rates: They offer competitive rates on loans.

- Flexible Payments: Different options for repaying your loan.

- Support: Help available throughout the loan process.

5. Is Indiabulls Housing Finance a trustworthy company?

- Yes, Indiabulls Housing Finance is a well-known and trusted company for housing finance.

Comclusion

Indiabulls Housing Finance Ltd 2024: Indiabulls Housing Finance Ltd is a great choice for home loans and housing finance in India. They offer competitive rates, flexible payment options, and helpful support throughout the process. For more details, visit their website or get in touch with their customer support. You can also find more financial news and updates on finrollnews.com. If you have any other questions, feel free to ask!

READ MORE:-

Mahindra Finance Personal Loan Review: Eligibility & Documents Required For Personal Loan In India

Bajaj Finance Personal Loan Ltd: Home Loans, Cards, Insurance, Investments, Loan Against Property…