Indian Railway Finance Corporation Ltd 2024: (IRFC) plays a key role in funding the growth of Indian Railways. The company raises money from both local and international sources to support various railway projects.

In 2024, IRFC is focused on leasing and financing. It leases trains and railway infrastructure and provides loans to organizations related to the Ministry of Railways. Leases for trains usually last 30 years: the first 15 years cover the cost and interest, while the next 15 years involve a small rent.

IRFC also raises money by issuing bonds, taking loans from banks, and using other financial methods. These activities help support and improve the infrastructure of Indian Railways.

Indian Railway Finance Corporation Ltd 2024

Must Read:- Jio Finance Share Price Today 2024: Jio Financial Services gets nod to increase foreign investment limit…

Indian Railway Finance Corporation share price range

Indian Railway Finance Corporation share Key Metrics

| Market Cap ( ₹ Cr.) | 2,39,689.50 |

| Beta 0.82 Div. Yield (%) 0.82 P/B 4.87 D/E 8.02O pen Price 183.65 | TTM P/E 35.13 Peg. Ratio 5.80 Sector P/E 16.55 Prev. Close183.30 |

Indian Railway Finance Corporation stock Analysis

| 1 Week | 2.60% |

| 3 Months | -0.32% |

| 6 Month | 19.72% |

| YTD | 84.61% |

| 1 Year | 277.39% |

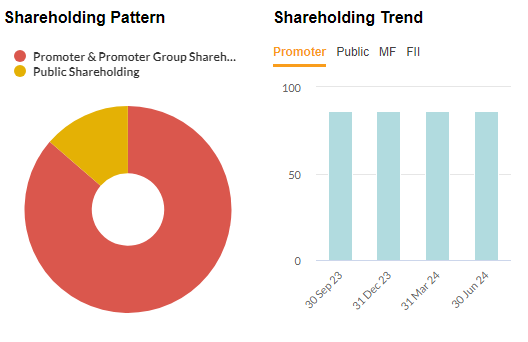

Indian Railway Finance Corporation Shareholding

Indian Railway Finance Corporation Company profile

ABOUT Indian Railway Finance Corporation

- Industry – Rental & Leasing

- ISIN – INE053F01010

- BSE Code – 543257

- NSE Code – IRFC

Indian Railway Finance Corporation Ltd 2024 (IRFC) is an Indian company that raises funds to support the development of Indian Railways. It mainly leases and finances railway-related assets, including trains and railway infrastructure. IRFC also provides loans to other organizations connected to the Ministry of Railways.

Typically, a lease for rolling stock (like trains) lasts 30 years, divided into two parts: 15 years where lease payments cover the cost and interest, and another 15 years with a small rent. IRFC also lends money to Rail Vikas Nigam Limited and IRCON. For its own funding, IRFC issues bonds, takes loans from banks, and uses commercial papers and other financial tools.

Income (profit&Loss)

| Quarterly | Annual | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 |

|---|---|---|---|---|---|

| Total Income | 6,766.02 | 6,477.99 | 6,745.31 | 6,767.48 | 6,681.03 |

| Total Income Growth (%) | 4.45 | -3.96 | -0.33 | 1.29 | 6.51 |

| Total Expenses | 34.28 | 35.95 | 36.79 | 36.12 | 33.49 |

| Total Expenses Growth (%) | -4.65 | -2.29 | 1.87 | 7.86 | -33.48 |

| EBIT | 6,731.74 | 6,442.04 | 6,708.52 | 6,731.36 | 6,647.54 |

| EBIT Growth (%) | 4.50 | -3.97 | -0.34 | 1.26 | 6.83 |

| Profit after Tax (PAT) | 1,576.83 | 1,717.32 | 1,604.23 | 1,549.87 | 1,556.57 |

| PAT Growth (%) | -8.18 | 7.05 | 3.51 | -0.43 | 17.24 |

| EBIT Margin (%) | 99.49 | 99.45 | 99.45 | 99.47 | 99.50 |

| Net Profit Margin (%) | 23.31 | 26.51 | 23.78 | 22.90 | 23.30 |

| Basic EPS (₹) | 1.21 | 1.32 | 1.23 | 1.20 | 1.20 |

Balance Sheet

| Annual | FY 2024 | FY 2023 | FY 2022 | FY 2021 | FY 2020 |

|---|---|---|---|---|---|

| Total Assets | 4,85,082.43 | 4,91,146.75 | 4,49,980.22 | 3,78,051.72 | 2,75,934.17 |

| Total Assets Growth (%) | -1.23 | 9.15 | 19.03 | 37.01 | 33.56 |

| Total Liabilities | 4,35,903.86 | 4,45,676.43 | 4,08,983.88 | 3,42,138.34 | 2,44,971.74 |

| Total Liabilities Growth (%) | -2.19 | 8.97 | 19.54 | 39.66 | 34.91 |

| Total Equity | 49,178.57 | 45,470.32 | 40,996.34 | 35,913.38 | 30,962.43 |

| Total Equity Growth (%) | 8.16 | 10.91 | 14.15 | 15.99 | 23.71 |

| Current Ratio (x) | 1.09 | 2.08 | 1.06 | 2.28 | 3.06 |

| Total Debt to Equity (x) | 8.38 | 9.21 | 9.47 | 9.00 | 7.57 |

| Contingent Liabilities | 169.01 | 0.02 | 0.42 | 0.42 | 0.43 |

Cash Flow

| Annual | FY 2024 | FY 2023 | FY 2022 | FY 2021 | FY 2020 |

|---|---|---|---|---|---|

| Net Cash flow from Operating Activities | 7,914.10 | -28,583.83 | -64,412.28 | -89,906.65 | -62,717.59 |

| Net Cash used in Investing Activities | -7.54 | 0.09 | -4.72 | 0.42 | 1.47 |

| Net Cash flow from Financing Activities | -8,046.42 | 28,643.28 | 64,266.30 | 90,202.04 | 62,713.79 |

| Net Cash Flow | -139.87 | 59.54 | -150.70 | 295.81 | -2.33 |

| Closing Cash & Cash Equivalent | 22.77 | 206.03 | 146.49 | 297.19 | 1.38 |

| Closing Cash & Cash Equivalent Growth (%) | -88.95 | 40.64 | -50.71 | 0.00 | -62.77 |

| Total Debt/ CFO (x) | 52.06 | -14.66 | -6.03 | -3.59 | -3.74 |

Must Read:- Power Finance Corporation Ltd 2024: Share price today, Stock Price, Financials, Mutual Funds Invested & News

Ratio

| Annual | FY 2024 | FY 2023 | FY 2022 | FY 2021 | FY 2020 |

|---|---|---|---|---|---|

| Return on Equity (%) | 13.03 | 13.93 | 14.85 | 12.29 | 11.92 |

| Return on Capital Employed (%) | 53.32 | 9.08 | 48.56 | 7.25 | 7.39 |

| Return on Assets (%) | 1.32 | 1.29 | 1.35 | 1.16 | 1.33 |

| Interest Coverage Ratio (x) | 1.32 | 1.36 | 1.43 | 1.39 | 1.37 |

| Asset Turnover Ratio (x) | 0.05 | 0.05 | 0.05 | 0.05 | 5.01 |

| Price to Earnings (x) | 29.07 | 5.49 | 4.60 | 6.79 | – |

| Price to Book (x) | 3.78 | 0.76 | 0.68 | 0.84 | – |

| EV/EBITDA (x) | 22.53 | 19.04 | 20.62 | 22.52 | – |

| EBITDA Margin (%) | 99.54 | 99.60 | 99.40 | 99.28 | 99.52 |

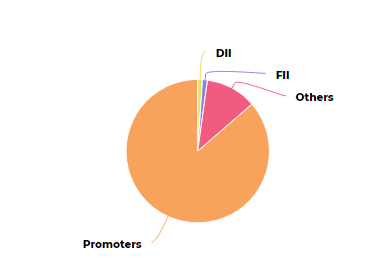

IRFC Shareholding Pattern

| Category | No. of Shares | Percentage | % Change QoQ |

|---|---|---|---|

| Promoters | 11,28,64,37,000 | 86.36 % | 0.00 |

| Pledge | 0 | 0.00 % | 0.00 |

| FII | 14,49,92,445 | 1.11 % | 0.03 |

| DII | 13,94,92,888 | 1.07 % | 0.18 |

| MF | 7,15,86,985 | 0.55 % | 0.37 |

| Others | 1,49,75,83,667 | 11.46 % | -0.21 |

FAQ’s

What is IRFC?

IRFC, or Indian Railway Finance Corporation Ltd, is a government company that helps fund railway projects in India. It raises money by selling bonds to investors.

What does IRFC do?

- Raises Money: IRFC sells bonds to get money for railway projects.

- Leases Equipment: It buys equipment for the railways and rents it out.

- Funds Railway Projects: It provides money for building and improving railway infrastructure.

How can I invest in IRFC bonds?

You can buy IRFC bonds through banks, financial institutions, or brokers. For more details, visit the IRFC website or talk to a financial advisor.

What are the benefits of investing in IRFC bonds?

- Regular Payments: You get regular interest payments from these bonds.

- Safe Investment: Since IRFC is government-owned, its bonds are considered safe.

- Tax Benefits: Some IRFC bonds might offer tax advantages.

Are IRFC bonds listed on stock exchanges?

Yes, you can find IRFC bonds on stock exchanges like NSE and BSE, so buying and selling them is easy.

Conclusion

Indian Railway Finance Corporation Ltd 2024: To wrap it up, IRFC helps fund India’s railway projects by selling bonds. Investing in these bonds can provide you with regular interest payments and is generally safe since they’re backed by the government. For more information, visit the IRFC website or chat with a financial advisor. For the latest financial updates, check out finrollnews.com. If you need any more help, just let me know!

READ MORE:-

Bajaj Finance Personal Loan Ltd: Home Loans, Cards, Insurance, Investments, Loan Against Property…

Mahindra Finance Personal Loan Review: Eligibility & Documents Required For Personal Loan In India